Saving money is an important aspect of personal finance, but is it really worth it? While many financial experts advocate for saving as much money as possible, others argue that it may not always be the best option. In this article, we will explore the various perspectives on saving money and provide an expert’s opinion on whether or not saving is truly worth it.

The Importance of Saving Money

Before delving into whether or not saving money is worth it, it is important to first understand the importance of saving money. Saving money can provide a number of benefits, such as:

Building an emergency fund: An emergency fund is money that is set aside to cover unexpected expenses, such as medical bills or car repairs. Building an emergency fund can help individuals avoid going into debt when these types of expenses arise.

Investing in the future: Saving money can help individuals invest in their future, such as buying a home or starting a business.

Avoiding debt: By saving money and avoiding unnecessary expenses, individuals can avoid going into debt.

Achieving financial independence: Saving money can help individuals achieve financial independence, which means they have enough money to cover their living expenses without relying on a job or other sources of income.

These are just a few of the many benefits of saving money. However, despite these benefits, some experts argue that saving money may not always be the best option.

The Case Against Saving Money

Some financial experts argue that saving money may not always be the best option. One reason for this is that inflation can erode the value of savings over time. Inflation is the rate at which the general level of prices for goods and services is rising and, as a result, the purchasing power of currency is falling. This means that money saved today may not be worth as much in the future.

Another reason some experts argue against saving money is that it can limit an individual’s ability to invest in themselves. For example, if an individual is always saving money and not spending any of it on personal development, such as education or training, they may miss out on opportunities to improve their earning potential in the future.

Finally, some experts argue that saving too much money can lead to a lower quality of life. If an individual is always saving money and never allowing themselves to enjoy the fruits of their labor, they may become unhappy and feel unfulfilled.

Expert Opinion

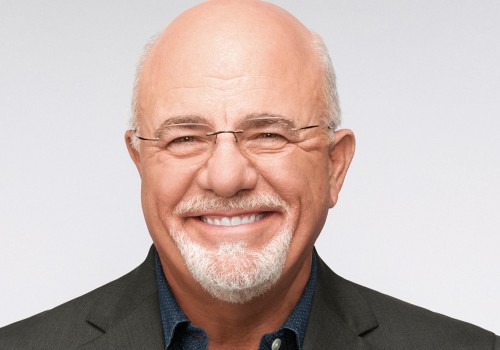

So, is saving money worth it? To answer this question, we spoke with financial expert and author, Robert Kiyosaki. Kiyosaki is the author of the best-selling book, “Rich Dad Poor Dad,” which has sold over 32 million copies worldwide.

According to Kiyosaki, saving money is important, but it should not be the only financial strategy an individual employs. “Saving money is like digging a hole in the ground,” says Kiyosaki. “It’s important to have a solid foundation, but if you just keep digging the hole, eventually you’re going to hit bedrock and you won’t be able to dig any deeper.”

Instead of relying solely on saving money, Kiyosaki suggests that individuals focus on increasing their financial education and investing in assets that generate passive income. This includes investments in real estate, stocks, and businesses.

Kiyosaki also stresses the importance of building a strong financial foundation by paying off debt and building an emergency fund. “You need to have a strong foundation before you can start building up,” says Kiyosaki. “Once you have that foundation in place, you can start investing in assets that generate passive income and increase your financial freedom.”

In terms of the argument that saving money can limit an individual’s ability to invest in themselves, Kiyosaki believes that it is important to strike a balance between saving and investing in personal development. “Investing in yourself is important, but it shouldn’t come at the expense of your financial security,” says Kiyosaki. “You need to find a balance between saving and investing in yourself to ensure that you have the financial freedom to pursue your goals.”

In conclusion, saving money is an important aspect of personal finance, but it should not be the only financial strategy an individual employs. While saving money can provide a number of benefits, such as building an emergency fund and investing in the future, it is important to also focus on increasing financial education, investing in assets that generate passive income, and striking a balance between saving and investing in personal development.

References:

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Importance of Saving Money” by The Balance

- “Is Saving Money Worth It? The Pros and Cons” by Forbes

- “Is Saving Money Worth It? Here’s What Financial Experts Say” by CNBC

- “Why Saving Money is Not Always the Best Financial Plan” by The Motley Fool.